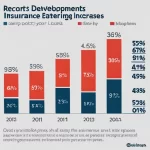

Recent developments in the auto insurance sector indicate a trend of rising insurance premiums and rate increases across various states. Here are some of the notable points from different sources:

- In some states, policyholders are experiencing significant rate increases. For instance, nearly 2 million policyholders are expected to face an average rate hike of about 14%, with Arizona and Louisiana being particularly affected1.

- Auto insurance shopping rates reportedly rose by 12% year-over-year in the second quarter of 2023, with vehicle sales playing a part in this increase2.

- Over the last few years, auto insurance premiums have seen substantial increases. Before the pandemic, the cost of insuring a new car was rising by an average of about 3% per year; however, this figure escalated to 5% between 2019 and 20203.

- In a positive turn, all Michigan drivers with auto insurance are slated to receive a $400 per-vehicle refund next spring, as a result of decreased driving and crashes during the lockdowns, which also led to insurance discounts4.

These data points reflect a mixed bag of rising costs and occasional refunds in the auto insurance sector, capturing the fluctuating nature of the industry amidst external factors such as vehicle sales and pandemic-induced changes in driving behavior.